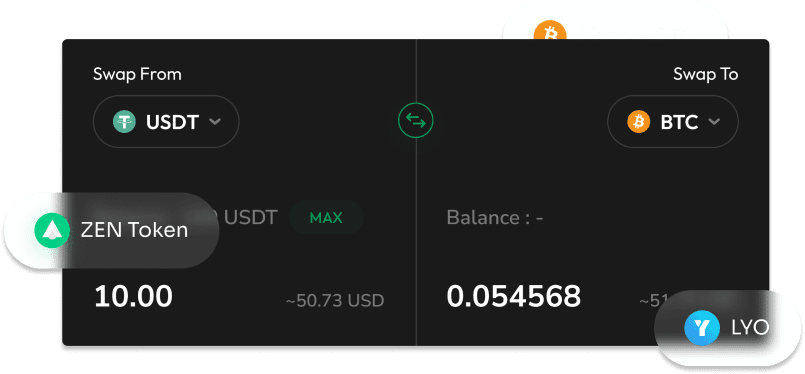

Zenit’s Crypto Swap Feature

Makes Exchanging Crypto Easy

Effortlessly exchange one cryptocurrency for another with our user-friendly swapping feature and enjoy low fees.

Why Choose Zenit’s Swap Feature?

Seamless Experience

Enjoy a user-friendly interface for easy swapping and management of different cryptocurrencies.

Optimal Rates

Benefit from the liquidity of major exchanges for the best possible exchange rates.

Flexible Trading

Execute market and limit orders for precise trading control.

How it Works

Discover the simplicity of Zenits Swap feature

01.

Deposit Funds

02.

Select Cryptocurrency

03.

Set order Details

04.

Confirm & Execute

05.

Track Transaction History

FAQs

What is Crypto Swap?

A crypto swap is the process of exchanging one cryptocurrency for another without using traditional financial intermediaries like banks or exchanges. It can be done on various online platforms and decentralized exchanges (DEXs). Users provide the desired amount and type of cryptocurrency they want to swap and receive the equivalent amount of another cryptocurrency in return, based on current market rates. Crypto swaps are popular for diversifying portfolios, accessing new cryptocurrencies, or converting one's holdings.

Are there fees for swapping crypto?

Yes, there are often fees or costs associated with swapping cryptocurrencies. These fees can vary depending on several factors:

• Exchange or Platform Fees: Whether it’s a centralized cryptocurrency exchange or a decentralized exchange (DEX), you may be charged a fee for swapping crypto. Centralized exchanges typically have a fee structure that includes trading fees, which can vary based on the exchange and your trading volume. DEXs may charge network fees for using their platform.

• Network Fees: Most cryptocurrency transactions involve network fees, commonly known as `"`gas fees`"` on blockchain networks like Ethereum. These fees cover the cost of processing and validating the transaction on the blockchain. The amount of network fees depends on network congestion and the complexity of the transaction.

• Service Fees: Some third-party services and platforms that facilitate swaps may charge additional service fees on top of network fees. These fees vary among providers.

• Slippage: In decentralized exchanges, you may encounter slippage, where the executed swap price differs slightly from the expected price due to market fluctuations and liquidity conditions. This can result in a cost, although its not a traditional fee.

It`'`s essential to check the fee structure of the specific exchange or platform you`'`re using and be aware of the associated costs before making a cryptocurrency swap. Fees can significantly impact the overall cost of your crypto transactions.

Is swapping better than trading?

Swapping and trading in cryptocurrencies serve different purposes. Swapping is ideal for quickly exchanging one cryptocurrency for another, while trading involves actively buying and selling assets to take advantage of price fluctuations. Swap is similar to a market order in the sense that you’ll have to pay whatever is the market rate at the time. Swap is a good option if you want to dip your toes in the crypto market owing to its lower fees.

How do you earn from swaps?

You can use crypto swaps to do arbitrage, taking advantage of price variations across exchanges on the same cryptocurrency; engaging in yield farming by staking assets for rewards; or strategically timing swaps to capitalize on market movements, aiming to buy low and sell high.